How to get Bike, Scooty and Car Insurance Online sitting at home? How to Compare Online Insurance.

Friends , today we are going to tell you how you can take online home insurance plan for Bike , Scooty and Car .

What types of car insurance are available in Australia?

Comprehensive

This provides an extensive level of coverage. It can help cover the cost of repairs to your vehicle in the event of accidental or malicious damage, theft, fire, hail, and third party damage (regardless of fault).

Third Party Property

This typically covers you for damage you cause to other people’s property, such as their car or property in a car accident. Unlike comprehensive, it typically doesn’t cover damage to your car.

Third Party Fire & Theft

This typically covers damage to other people’s property and can provide limited cover for damage to your car as a result of theft or fire. It typically does not cover you for other damage caused to your car.

Compulsory Third Party (CTP) or Greenslip

As its name suggests, CTP is a minimum compulsory insurance required to drive on Aussie roads. Depending on which state you live in, it could be included in the cost of your vehicle registration, or you may have to purchase it separately from an insurer. CTP helps cover the cost of compensation claims if you injure or kill someone in a car accident.

How you can compare car insurance quotes with iSelect*

Get acquainted

After entering your registration, we’ll ask a few questions about your vehicle so we can help you find policies from our range of providers.

Consider the policy you’re looking to purchase. Are you looking for a new provider, a cheaper premium, and even better coverage?

Understand your options

When selecting car insurance, it’s important to understand your options. With iSelect you can compare comprehensive policies, and review monthly premiums, inclusions, and exclusions.

You may also consider optional extras from some providers, like roadside assistance or reducing the window glass excess.

Get covered

Found a policy that works for you? Easily purchase the policy online or via phone with iSelect.

Before purchasing, always read the Product Disclosure Statement (PDS) to get a better understanding of policy limitations and exclusions – this could help avoid nasty surprises when it’s time to claim.

How to take motorcycle insurance online? What is the method of taking online car insurance? What is Bike, Scooty, Car insurance price in 2019?

(Vehicle Insurance Online/Online Bike Insurance Renewal/Online Insurance Compare). How can you find out which is the best insurance plan ? _ In the beginning , when we get a new car , then the companies take the insurance money along with it and give us 1 year insurance along with the car . is . Many times , due to some offers , insurance is also made for free along with our new vehicle .

Is it necessary to get car insurance ?

Insurance is very important for our vehicle (Bike Scooty Car Insurance ) . Bike Scooty Car Insurance has been made mandatory by our government . Friends , there are many insurance companies but all have different charges , different benefits and different services . _ _ _ _ _ _ _ is .

What are the types of car insurance ? _ Types of Bike, Scooty and Car Insurance?

Friends Insurance is of different types like Third Party Insurance and the other is Driver ‘s Personal Accidental Insurance and Zero Depreciation with Third Party Insurance .

What is Zero Depreciation ? What is the advantage of Zero Depreciation ?

What is Personal Accidental Insurance ? What is the benefit of Personal Accidental Insurance ?

Zero Depreciation means that some money in the name of Zero Depreciation is added to your Bike / Scooty / Car Insurance . The advantage of Zero Depreciation is that whenever there is any kind of wear and tear in our Bike / Scooty /Car and an accident happens , then you The company itself gets all the work done . You do not have to invest money from your pocket , you only have to pay some percent (% ) of the total expenses and this rate varies from company to company . It is our wish that we take only Third Party Insurance Want or want to add Driver ‘s Personal Accidental Insurance and Zero Depreciation also with it .

What is Third Party Insurance ? What are the benefits of Third Party Insurance ?

Is it necessary to get Third Party Insurance ?

Only Third Party Insurance has been made mandatory by our government while Driver ‘s Personal Accidental Insurance depends on his wish and certain conditions . Like if the driver does not have a Driving License or the Driving License has expired or the vehicle is in someone else ‘s name But if it is registered then it is not mandatory for the driver to take Personal Accidental Insurance .

For information , let us tell you that Third Party Insurance is very useful for us , such as if we have an accident while driving , Third Party Insurance is very useful for making a case in the court and for taking other action . Without this you can file a case in court . Ca n’t enter so it is mandatory . _ _

In how much money is the insurance of Bike, Scooty and Car ?

In how much money is Zero Depreciation done ?

How much is Personal Accident Insurance ?

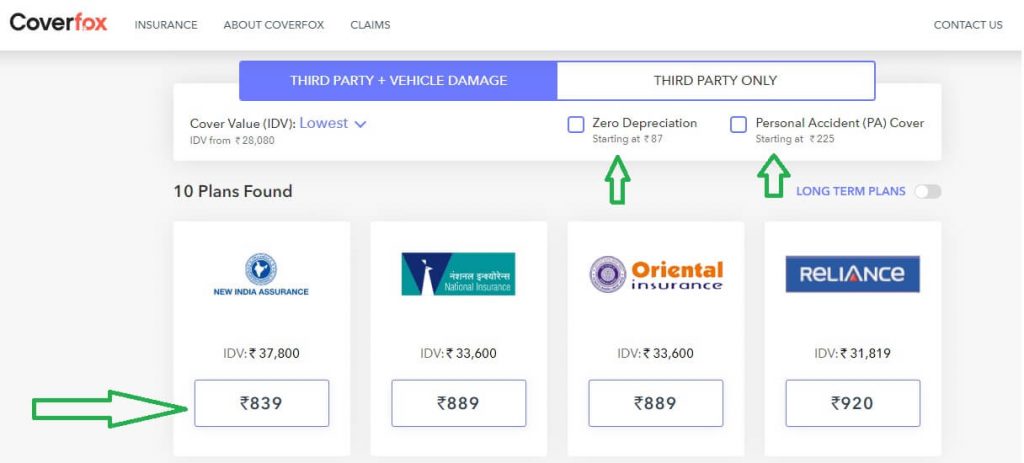

Friends , our opinion is that while taking Third Party Insurance , you should include Zero Depreciation and your Personal Accidental Insurance in it , because the cost of Third Party Insurance is the highest , such as around Rs 850 , and the cost of Zero Depreciation is around Rs 87 . starts at Rs . And the price of Personal Accidental Insurance starts from around Rs.225 with it . _ Friends , this price is not much , with this you get its wear and tear and your insurance is included with your car .

How to do Bike, Scooty and Car insurance online ?

How to see Bike, Scooty and Car Insurance Plan Online ?

Which are the companies that insure Bike , Scooty and Car ? _ _

Insurance companies of Bike, Scooty and Car ?

How to see the best insurance plan for Bike, Scooty and Car ?

How to see the cheapest insurance plan for Bike , Scooty and Car ?

Compare Bike, Scooty और Car Insurance.

Friends , in today ‘s time , there are many such websites online through which we can buy online insurance , such as Bajaj Allianz , IFFCO Tokio , ICICI Lombard , Policybazaar , CoverFox , all these companies provide all types of insurance such as Health Insurance , Travel Insurance, Car Insurance, Two Wheeler Insurance etc.

Which website is good for Insurance of Bike , Scooty and Car ?

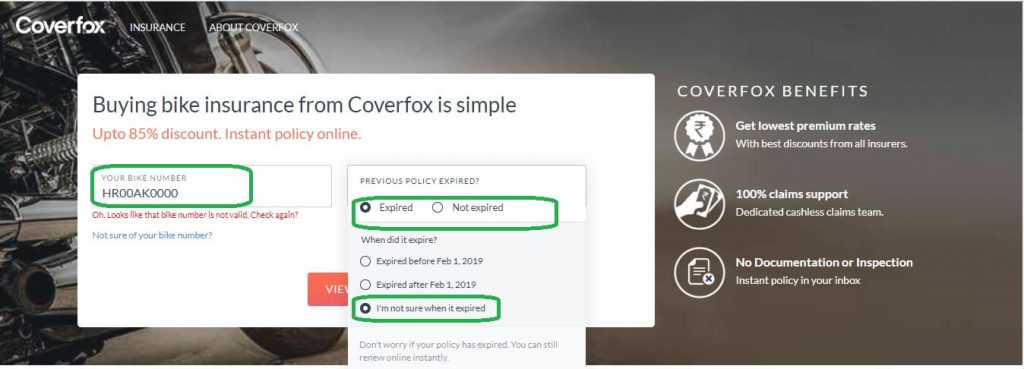

Friends , the best website of CoverFox is considered . _ Because whenever we see online insurance , all companies or all websites ask for our old insurance number , vehicle registration number and many more details and old _ _ _ _ _ _ _ Due to not having insurance with us or due to old insurance expire , all these websites and companies increase their insurance rates . _ _ _ _ _

But this does not happen at all in CoverFox , without entering the insurance number , you can get your car insured very comfortably . _ But friends , still you must check all the websites once on your own basis . _ _ _ _ _

You will be able to see the plans of all companies by visiting CoverFox ‘s website and the cheapest insurance plan will also be shown to you at the top . When you are shown the insurance plans of all companies , then you can see their services and advantages and disadvantages . that If you like the insurance plan , you can take it . As soon as you buy the insurance of a company , at the same time you get its receipt and your Insurance Police document on your mail . _

When should bike scooty and car insurance be done ?

If the insurance of our car is already running and we get it rebuilt till the last day for its completion , then it becomes very easy and we do not have to get any kind of vehicle checked up , but if your _ _ _ _ _ _ old The last date of insurance has passed and if you are late even for a few hours , then there is a lot of difficulty in getting insurance .

What to do after the insurance of Bike Scooty and Car is over ?

How to stop the cost of Bike Scooty and Car from being reduced in Insurance ?

If you just want to get Third Party Insurance done , then there is not much problem , but if you want to take Accidental Insurance with Third Party Insurance , then some members of the company from which you will get Insurance done , come and check your Bike/Scooty/Car . Will examine and then he Will put the cost of that vehicle inside the insurance . If this happens then the price of your car decreases significantly , because the members of the insurance company see the smallest shortcomings of your car and then do not charge much for your car under insurance . _ _ _ are .

Due to the old policy , if you get your new insurance made by paying money in Ajay himself or in the insurance company in the last days of the old policy , then the cost of your watch is reduced by a few percent , along with that the cost of getting your insurance done as well. with It decreases every year and the value of your car also decreases gradually . _ _ _ _

So friends , first of all , whenever we want to get insurance , then it must be kept in mind that before the last date of your insurance , you should get your car insured , so that you do not have any problem in getting it insured again and the cost of your car Bhi na ghate .

Friends, you should read this post of ours “How to do Bike, Scooty and Car Insurance Online sitting at home? Compare Insurance online. Do tell us how you liked it. If you have any question regarding Bike, Scooty and Car Insurance Online, then you can ask us through the comment box.